The Carbon Capture Conundrum: Smart Investment or Strategic Escape?

- Sarah Warner

- Dec 8, 2025

- 7 min read

Updated: Dec 9, 2025

The Dual Challenge

The world faces two opposing challenges. Most major economies have committed to dropping carbon emissions and aspiring to “net zero” within the next few decades. To the contrary, governments are also desperate to boost energy security and bring down soaring energy costs, which feeds into cost-of-living crises, increases the poverty gap and stimulates civil unrest. With this in mind, not taking advantage of the remaining reserves of fossil fuels is something many just cannot afford. A fitting example, where, in reality, pursuing the E (environment) can come at the cost of S (social) – and vice versa – when working towards ESG goals.

The notion of utilising carbon reduction techniques to eradicate net emissions sits uneasily with many environmentalists, whose preference is to remain focused on reducing emissions. The main cause of global warming is greenhouse gas emissions, and therefore there is no doubt that we need to prioritise cutting our emissions. However, many believe this alone will not be enough, and that part of the solution will have to involve capturing some of the gases that have already been released: this process is known as carbon capture.

What is Carbon Capture?

Carbon capture, usage and storage (CCUS) refers to a group of technologies that mitigates carbon dioxide (CO₂) emissions from large sources such as power plants, refineries and other industrial facilities, or removes existing CO₂ from the atmosphere. CCUS technologies could therefore provide an avenue to address both these environmental and social challenges. Additionally, there is a necessity of continuing to operate at least some carbon-emitting industries, such as the production of cement, steel, glass, and in processes such as waste treatment. This means that a large amount of carbon will need to be captured if net zero is to become achievable.

“Renewable power alone isn’t going to get the world to net zero” - Tom White of C-Capture - “Even when everything that can be decarbonised has been decarbonised, there are still significant sources of greenhouse gas emissions that are not energy-related but created in the chemical process itself of making vital products that society needs.” (MoneyWeek).

How Does CCUS Work?

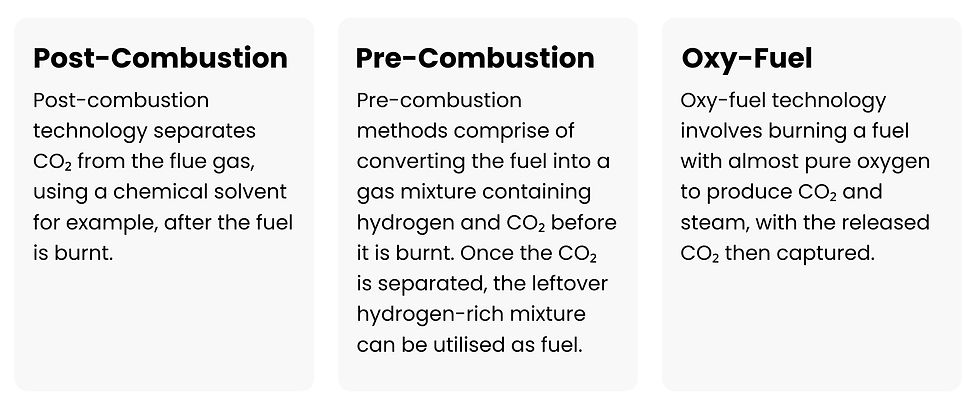

CCUS involves three stages. CO₂ is captured, transported and stored (or used). The main methods for capturing CO₂ are either post-combustion, pre-combustion or oxy-fuel combustion.

Post-combustion and oxy-fuel apparatus can be either fitted to new plants or retrofitted to existing plants that were originally built without them. Pre-combustion methods, however, require greater modifications to the operations of the facility and, thus, are more suitable for new plants.

At present, operational facilities fitted with CCUS can capture around 90% of the CO₂ present in flue gas. It is technically possible to attain even higher capture rates, and research is underway to reduce the costs of achieving this. CO₂ can also be captured directly from the atmosphere, in a process that draws in air using fans and then passes it through either solid sorbents or liquid solvents. This process is more energy-intensive and, thus, more expensive as CO₂ has a much lower presence in the atmosphere than it does in flue gas.

Once the CO₂ has been captured, it is then compressed into a liquid and transported via pipeline, ship, rail or road tanker. CO₂ can then be inserted—usually at depths of 1 km—or more into deep geological formations such as, depleted oil and gas reservoirs, coalbeds or deep saline aquifers, where the geology is apposite. There is evidence to suggest that there is more underground storage available globally than is actually required to meet climate targets and almost every high-emitting nation has now demonstrated having their own substantial storage resource.

Why Is It Important?

Carbon capture can play a significant role in global decarbonisation efforts through a number of ways, such as reducing emissions in industries that are particularly difficult to decarbonise. For example, it is virtually the only existing technological option for enabling deep emissions reduction in cement production, which is an industry that produces almost 7% of the world’s emissions.

Low-Carbon Electricity and Hydrogen

Carbon capture produces low-carbon electricity and hydrogen, which can then be used to decarbonise various activities and it also enables us to remove existing CO₂ from the atmosphere.

Energy Security

This variety of application can assist us to make the energy supply more diverse and flexible. Ultimately, this leads to increased energy security, which as mentioned is a growing priority for governments around the world.

As carbon capture allows us to produce electricity and hydrogen in a low-carbon manner, it can therefore facilitate efforts to move a wider range of sectors away from reliance on fossil fuels. It can be installed on power plants running on coal, gas, biomass or waste and the low-carbon electricity created can then replace fossil fuels as an energy source. Such energy can be used in personal transport, heating, and heat extraction in industry. Whilst hydrogen can provide us with a more direct substitute for fossil fuels in combustion processes, industrial applications, and in long-haul transport.

New Possibilities

In April 2025, the BBC reported that a ‘ground-breaking project to suck carbon out of the sea has started operating on England's south coast’. This project named ‘SeaCURE’, is funded by the UK government as part of its pursuit of innovative technologies that can assist us in the fight against climate change.

As carbon capture focuses on either capturing emissions at their source or pulling them from the air, SeaCure is significant because, profoundly, it is testing whether actually it is more effective to pull planet-warming carbon from the sea, based on the fact that it is exists in greater concentrations within water than it does in the air. This innovation demonstrates that carbon capture continues to develop, expand and evolve—creating new possibilities and tools to combat climate change and further investment opportunities.

How Can We Invest in It?

At Alpha Beta Partners, we invest in the Pictet Clean Energy Transition fund across the Sustainable portfolios. This fund invests in RWE, who over the next three years are investing in carbon capture technology and hydrogen combustion projects, to assess how these technologies can decarbonise their gas-fired power stations. RWE’s target is for the first of their fleet to be converted and running a decarbonised operation before 2030.

Also within the Sustainable portfolios is the Climate Assets Balanced Fund (recently renamed Sustainable Opportunities Fund, having achieved its sustainable focus SDR label) which has exposure to companies contributing to the carbon capture, usage and storage (CCUS) value chain.

Is Carbon Capture the Answer?

Let’s be pragmatic. Absolutely, carbon capture should not replace the primacy of reducing emissions, as we strive to carry out the global transition to a low carbon, sustainable and circular economy. However, if solely focusing on emission reduction creates further disparity in living costs, increases poverty and hardship, or simply cannot be achieved in the time needed, it needs to be accompanied by additional solutions.

The Intergovernmental Panel on Climate Change (IPCC) is a body of the United Nations whose job is to provide governments at all levels with the scientific information needed to develop climate policies. Their Sixth Assessment Report found that “the deployment of carbon dioxide removal to counterbalance hard-to-abate residual emissions is unavoidable if net zero CO₂ or GHG emissions are to be achieved”.

Additionally, principal organisations including the International Energy Agency (IEA), International Renewable Energy Agency (IRENA), and Bloomberg New Energy Finance (BNEF) have all formed long-term energy outlooks that depend on a rapid expansion of CCUS in order to limit the global temperature rise to 1.5°C.

So, if we cannot achieve net zero and energy security for all without carbon capture, it would appear that as an investment it has assured growth potential as well as being a sustainable investment that has full governmental support. The topic of carbon capture has once again highlighted the ambiguity surrounding ESG and how people have diverse approaches when it comes to how they want to invest responsibly, as I previously touched upon with sentiment towards defence stocks.

Case Study: Rolls-Royce

One company that perfectly illustrates this complexity of ESG investing and brings all these topics together is Rolls-Royce, which we hold across our Core and Core Plus range. As a stock example, the activities of Rolls-Royce span many previous ESG topics written about at Alpha Beta—defence, nuclear power, hydrogen, and now carbon capture. Rolls Royce is an aerospace and defence company, which on the face of it, you would consider not an appropriate investment for a responsible investor. But pragmatically (as previously discussed), some responsible investors may believe that you cannot have peace without defence, or support the autonomy and safety of smaller, more vulnerable countries.

A Complex ESG Profile

Rolls Royce state that they ‘are determined to use their position, capabilities and expertise as a global power group to help create a resilient, inclusive, low carbon future and support the energy transition for the sectors they serve’. Rolls-Royce’s current work focuses on aerospace and defence power and as market leaders in military air and naval power solutions, they are increasing efficiency and sustainability in power in these areas. Rolls-Royce has also undertaken work on carbon capture, collaborating on a UK government-funded programme to build and test a direct air capture (DAC) prototype in Derby.

The Sustainable Defence Paradox

Perversely, could Rolls-Royce become an ESG investing oxymoron because it potentially constitutes a ‘sustainable-defence’ company? In these times of geopolitical chaos, and the occasions when the E and S of ESG are not in unison, is there a place for such a holding in a responsible portfolio.

Performance vs Values

Undoubtedly, a good investment performance-wise, with Rolls-Royce positioning itself to become the UK's most valuable company, by leveraging its nuclear-powered small modular reactors (SMRs) to meet the energy demands of artificial intelligence (AI), but where does it sit values-wise?

Ultimately, like the conclusion on carbon capture, and when the ESG lens can become blurry, it falls once again to personal choice, having all the information possible, and what sits comfortably within your values base.

Further Readings